NFC payment

Originally, NFC was developed to enable contactless payments in a secure and convenient way. Although the technology exists for several years now, payments via credit cards are still much more common in the US than NFC payments. Moreover, NFC payments lacked the support of banks and most stores weren’t equipped with a NFC-enabled point of sale (POS) terminal.

However, various stories of fraud discovered at retail chains such as Target, Home Depot, Michael’s and more revealed that magnetic stripe-based payments in the US are quite insecure. Meanwhile, several retailers such as Target, Macys and Walgreens were equipped with NFC-enabled POS terminals and wallet apps like Google Pay and Apple Pay got more and more popular. Nevertheless, many people wonder how NFC payments actually work and how secure NFC transactions are.

Principle of NFC payment

Meanwhile, Google Pay for Android and Apple Pay for Apple devices are becoming more and more practical and in most cases allow a secure and uncomplicated payment method. The only requirement for this is an NFC-capable smartphone and the linking of your own bank card with Google or Apple Pay. If an NFC payment terminal is available, it is then sufficient to simply hold the smartphone up to the payment terminal to pay. To pay with the smartphone, the mobile payment app must be downloaded. For all owners of an Android smartphone this means: Google Pay. Google works together with several banks in Germany. The credit card of your own bank can be deposited digitally and free of charge in this app. In addition, your own PayPal account can be linked to the Google Pay account. For iPhone (Apple Watch) users Apple Pay must be installed. Technically, mobile payment via smartphone works basically like this: If your own credit or gircard is stored digitally in the app, the mobile phone usually does not store your real credit card number. Instead, there is a kind of digital recognition code for the payment process, which can later be assigned to the credit card. If the smartphone is then held directly against the payment terminal at the checkout, the smartphone and the checkout communicate with each other via the NFC chip. For amounts up to 25 euros, this often works without unlocking the display or entering a pin. In another article we will go into more detail about how exactly payment with Google or Apple Pay works. Learn more about how payment with NFC works.

Security of NFC payment

As payment transactions require the transfer of sensible information like credit card data, customers are always sceptical about new payment options like NFC. Customers have important questions for example if the transfer of payment data is secure or if criminals can get access to payment information. These concerns are supported by various media reports about criminals who are able to read NFC credit cards via smartphone apps.

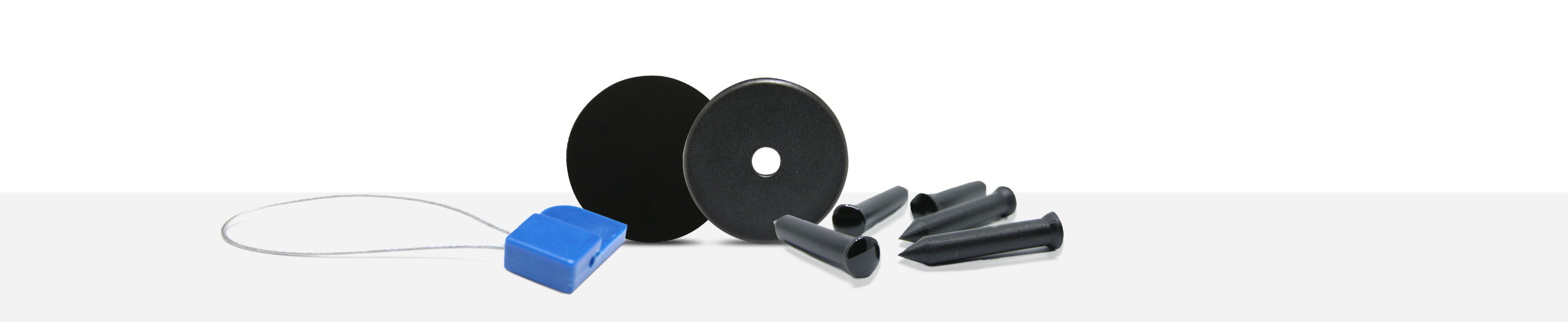

As security is an important issue, we answer frequently asked questions about security of NFC payment. Furthermore, we present an easy solution to protect your NFC credit card against unauthorized reading.